Easy start

Start your journey with just one simple document, send it just from your home

Start your journey with just one simple document, send it just from your home

We ensure your data remains secure and provide support during challenging times

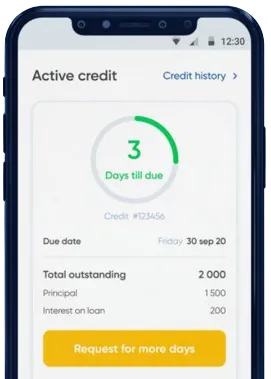

Enjoy instant fund transfers and flexible loan extension opportunities

Fill out a straightforward form through our user-friendly app to begin your loan application.

Get a decision on your application in as little as 15-30 minutes — efficient and hassle-free.

Your funds are typically processed and available very quick after approval.

Submit an application via our app. Just fill out a simple form.

Download loan app

| Option | Interest Rate | Fee | APR | Loan Amount |

|---|---|---|---|---|

| Option 1 | 5% | 3% | 36% | 7,000 KES |

| Option 2 | 7% | 4% | 28% | 14,000 KES |

| Option 3 | 10% | 6% | 20% | 35,000 KES |

| Option 4 | 12% | 8% | 15% | 70,000 KES |

| Option 5 | 15% | 10% | 10% | 350,000 KES |

In Kenya, SMS loans have become a popular financial service for many individuals in need of quick cash. These loans are easily accessible through mobile phones, making them a convenient and efficient way to borrow money in times of financial emergencies. Whether you're facing unexpected expenses or need funds to cover daily necessities, SMS loans offer a flexible and hassle-free solution to meet your financial needs.

One of the standout features of 100 SMS loans is their ability to cater to a large number of borrowers simultaneously. This means that regardless of how many people require quick financial assistance at the same time, these loans remain accessible and efficient. 100 SMS loans are designed to handle high demand without compromising on the speed or quality of service, ensuring that every applicant receives the support they need promptly. This scalability makes them an essential tool for managing widespread financial crises or supporting a large community during economic downturns.

When it comes to speed and efficiency, our service proudly stands as the fastest loan app in Kenya. In today's fast-paced world, waiting days for loan approval is no longer feasible, especially during urgent financial situations. Our loan app leverages cutting-edge technology to streamline the loan application process, reducing approval times from days to mere minutes. This rapid turnaround ensures that borrowers can access the funds they need without unnecessary delays, providing peace of mind and financial stability when it's needed most. Being the fastest loan app in Kenya, we prioritize your time and financial well-being by delivering swift and reliable loan services.

SMS loans in Kenya have revolutionized the way Kenyans access financial services. Unlike traditional loans that require extensive paperwork and long waiting periods, SMS loans offer a straightforward and expedited process. By simply sending a text message, borrowers can initiate their loan application and receive funds directly into their mobile money accounts. This ease of access has made SMS loans an attractive option for a diverse range of users, including students, professionals, and individuals with varying credit histories. The widespread adoption of mobile technology in Kenya has further fueled the popularity of SMS loans, making them an integral part of the country's financial landscape.

For those seeking a quick loan in Kenya, SMS loans present an ideal solution. The streamlined application process and rapid approval times make it easy to secure funds swiftly, ensuring that borrowers can meet their urgent financial needs without delay. Whether it's for emergency medical expenses, unexpected home repairs, or immediate cash flow requirements, quick loans in Kenya provide the financial support necessary to navigate through challenging times efficiently.

One of the key benefits of SMS loans in Kenya is the convenience and accessibility they offer. With just a few clicks on your mobile phone, you can apply for a loan and receive the funds directly into your mobile money account. This eliminates the need to visit a physical bank branch or fill out lengthy application forms. Additionally, SMS loans are available 24/7, making them ideal for emergencies that require immediate financial assistance. This accessibility has made SMS loans a popular choice for many Kenyans who need quick and easy access to cash.

Another advantage of SMS loans in Kenya is the quick approval and disbursement process. Unlike traditional bank loans that can take days or even weeks to be approved, SMS loans are typically processed within minutes. This means you can receive the funds you need in a matter of hours, allowing you to address your financial needs promptly. Furthermore, SMS loans do not require a lengthy credit check or collateral, making them accessible to individuals with varying credit histories. This quick and hassle-free approval process is a major reason why many Kenyans turn to SMS loans for their financial needs.

SMS loans in Kenya typically offer flexible loan amounts and repayment terms to suit the individual needs of borrowers. Whether you need a small amount to cover basic expenses or a larger sum for a significant financial obligation, SMS loans can provide you with the funds you require. This flexibility ensures that borrowers can choose loan amounts that best fit their financial situation and repayment capacity.

Another benefit of SMS loans in Kenya is the convenient loan management options they offer. Through your mobile phone, you can easily track your loan status, repayment schedule, and outstanding balance. This transparency and accessibility make it easier for borrowers to stay on top of their loan obligations and avoid any unnecessary fees or penalties. Furthermore, many SMS loan providers offer automated repayment options, allowing you to schedule repayments directly from your mobile money account. This ensures that you never miss a payment and can effectively manage your loan without any hassle.

Loans via SMS provide a seamless and efficient way to access financial support. By utilizing your mobile phone, you can apply for and manage your loan without the need for traditional banking interactions. This method not only saves time but also offers greater flexibility, allowing you to handle your financial matters on your own terms. With loans via SMS, managing your financial obligations becomes easier and more accessible, empowering you to take control of your financial future with confidence.

Trust in a direct lender that values responsibility and innovation. Our best loan app Kenya prioritizes your data's security, employing advanced encryption and robust security measures to protect your personal information. We understand the importance of safeguarding your financial details, especially in hard situations. By choosing our app, you benefit from a secure borrowing environment where your information is protected, and your financial well-being is our top priority. Our commitment to safety ensures that you can navigate your financial challenges with confidence and peace of mind.

Additionally, our partnerships with trusted financial platforms like Palmpay and Opay enhance the security and reliability of our services, providing you with a dependable financial support system. These collaborations ensure that your transactions are processed securely, giving you peace of mind when accessing your funds.

As the best loan app Kenya, we strive to deliver unparalleled service quality and user satisfaction. Our app stands out by offering a combination of speed, security, and flexibility that meets the diverse needs of our users. Whether you're a student, a professional, or someone with a less-than-perfect credit history, our best loan app Kenya provides tailored loan solutions to help you achieve your financial goals. By continuously improving our services and incorporating user feedback, we ensure that our app remains the top choice for borrowers seeking reliable and efficient loan options.

Enjoy easy and quick loan solutions from the comfort of your home with our best loan app Kenya. Our uncomplicated process ensures instant transfers and convenient loan extension opportunities, allowing you to manage your finances without hassle. Whether you need an urgent loan of ₦10,000 without BVN for unexpected expenses or a larger amount for significant financial goals, our streamlined approach makes borrowing simple and efficient. With features like instant transfer and loan extension opportunities, you can access and manage your funds effortlessly, ensuring that your financial needs are met promptly and effectively.

Our user-friendly interface and straightforward application process eliminate unnecessary barriers, making it easier than ever to obtain the financial support you need. By simplifying the loan process, we ensure that you can focus on what matters most without being bogged down by complicated procedures.

Our fast loan without BVN service is designed to provide immediate financial support without the need for extensive documentation. By eliminating the requirement for a BVN, we make the loan application process more accessible and less cumbersome. This means that even individuals who do not have a BVN can still access the funds they need quickly and efficiently. Our fast loan services are ideal for addressing urgent financial needs, ensuring that borrowers can secure the necessary funds without unnecessary delays.

SMS loans in Kenya provide a convenient, accessible, and efficient financial solution for individuals in need of quick cash. With benefits such as quick approval, flexible loan amounts, and convenient loan management options, SMS loans have become a popular choice for many Kenyans facing financial emergencies. If you find yourself in need of immediate funds, consider exploring the benefits and usefulness of SMS loans in Kenya.

For those wondering, "Where to borrow money without BVN?" these loan apps provide a straightforward and efficient answer. With their user-centric design, quick approval processes, and flexible repayment options, loan apps in Kenya without BVN are transforming the way Kenyans access and manage their finances, making financial stability more attainable for everyone.

SMS loans are a convenient type of short-term, small-dollar loan that can be easily applied for and received through a simple text message on your mobile phone. Designed to provide swift financial assistance, these loans eliminate the need for extensive paperwork or visits to a bank. Typically, borrowers send an SMS containing specific keywords to a designated number, and upon approval, the loan amount is promptly disbursed directly to their mobile money account. This streamlined process ensures that individuals can access the funds they need quickly and efficiently, especially during financial emergencies.

In Kenya, obtaining an SMS loan involves sending a text message with specific keywords to a lending company's designated number. Once the lender receives your application, they assess your eligibility based on predefined criteria such as your mobile money account activity and repayment history. If your application meets the lender's requirements, the loan amount is instantly disbursed to your mobile money account. This immediate transfer allows you to access the funds you need without delay, making SMS loans an ideal solution for urgent financial needs.

To qualify for an SMS loan in Kenya, you generally need to be a Kenyan citizen or resident and own a mobile phone registered in your name. Additionally, having an active mobile money account is essential, as the loan funds are typically disbursed directly to this account. Lenders may also require you to meet their minimum income or transaction requirements and have a good repayment history with your mobile money account. These criteria help lenders assess your ability to repay the loan without the need for traditional credit checks or collateral, making SMS loans accessible to a broader range of individuals.

Yes, SMS loans in Kenya typically come with fees and interest charges. These may include a one-time processing fee when you apply for the loan, daily or weekly interest rates depending on the lender, and fees for late payments if you miss a repayment deadline. It's crucial to thoroughly read and understand the terms and conditions of the loan before applying to avoid any unexpected costs. Being aware of these fees ensures that you can manage your repayments effectively and maintain a good repayment history.

The repayment period for SMS loans in Kenya is typically short, ranging from a few days to a few weeks. Most lenders expect the loan to be repaid within one to four weeks. While some lenders may offer the option to extend the repayment period, this usually involves additional fees and higher interest rates. It is important to adhere to the agreed-upon repayment schedule to maintain a good standing with your lender and avoid incurring extra costs, ensuring that you can continue to access financial support when needed.

It is not recommended to apply for multiple SMS loans simultaneously in Kenya. Applying for several loans at the same time can lead to overborrowing, making it difficult to manage repayments effectively. Additionally, multiple loan applications can negatively impact your repayment history, potentially affecting your ability to secure future loans. It is important to borrow only what you need and can afford to repay to maintain financial stability and a good credit standing.